DAC 6: THE EU DIRECTIVE ON CROSS-BORDER ARRANGEMENTS

The EU Council Directive 2011/16 in relation to cross-border tax arrangements, known as DAC 6, has been in force since 25 June 2018. DAC 6 aims at transparency and fairness in taxation.

DAC 6 covers the mandatory disclosure and automatic exchange of information among EU states in the field of taxation related to reportable cross-border arrangements. The regulatory thread embodied in DAC 6 stems from Action 12 of the OECD’s Base Erosion and Profit Shifting project, finalised in 2015, which aimed to give each jurisdiction timely information on the compliance and policy risks raised by aggressive tax planning.

The primary goals of DAC 6 are to increase transparency, reduce uncertainty about beneficial ownership, and discourage intermediaries from developing, marketing, and implementing harmful tax schemes. Therefore, businesses need to understand the importance and implications of the Directive and the need to act now to ensure compliance by the specified deadlines.

The DAC 6 Directive Scope:

The main aim of the Directive is to provide tax authorities with an early warning mechanism on new risks of tax avoidance and tax planning and thereby enable them to conduct audits more effectively. Prior to the Directive, such cross-border arrangements did not need to be reported under EU legislation. The term aggressive tax planning is undefined; however, reference is made to a number of pre-determined hallmarks, which are features that could render a cross-border arrangement reportable under this Directive.

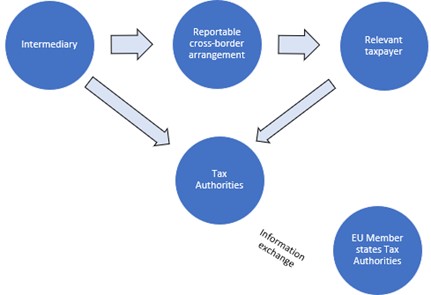

DAC 6 provides for mandatory disclosure of cross-border arrangements by intermediaries, or individual or corporate taxpayers, to the tax authorities and mandates automatic exchange of this information among Member States.

Reportable cross-border arrangement:

For cross-border arrangements to be reportable to the tax authorities, at least one of the hallmarks must be met. These hallmarks may be generic or specific. As regards the generic hallmarks and a number of specific hallmarks, these may only be considered as far as they meet the so-called “main benefit test.” This test will be met if obtaining a tax advantage constitutes the main benefit or one of the main benefits a person is expected to derive from an arrangement.

Who would have to report:

The reporting obligation would fall on intermediaries but also, in some specific cases, on relevant taxpayers.

In Cyprus, the legislation closely follows the wording of the Directive. In that respect, an intermediary is defined as a person who designs, markets, organises, makes available for implementation, or manages the implementation of a reportable cross-border arrangement (the promoter) or “any person that, having regard to the relevant facts and circumstances and based on available information and the relevant expertise and understanding required to provide such services, knows or could be reasonably expected to know that they have undertaken to provide, directly or by means of other persons, aid, assistance or advice with respect to designing, organising, marketing, making available for implementation or managing the implementation of a reportable cross-border arrangement” (i.e. “intermediaries-service providers”).

Where a particular intermediary is outside the EU or exempt from disclosing due to legal professional privilege (“LPP”), the obligation to disclose falls on another intermediary or, if none, to the relevant taxpayer. The disclosure includes details of intermediaries and relevant taxpayers, the associated parties of the latter (where appropriate) and the cross-border arrangement in question.

What must be reported and when:

Each Intermediary/Interested Taxpayer has the obligation to submit to the Tax Department the DAC 6 information for reportable cross-border arrangements that they have in their knowledge, possession or control, within 30 days calculated:

- from the day following the date on which the notifiable cross-border arrangement becomes available for application, or

- from the day following the date on which the notifiable cross-border arrangement is ready for implementation, or

- from the completion of the first stage of the application of the notifiable cross-border regulation, whichever occurs first.

Penalties:

Failure to comply with the reporting requirements entails heavy penalties, depending on the reasoning for such failure.

The penalties are as follows:

- Up to €20.000 when information for a Reportable Cross-Border Arrangement is not submitted on time or when it is submitted late

- Up to €20.000 for failing or waiting too long to inform when applying for a waiver

- Up to €10.000 for submitting inaccurate or missing information

- Up to €10.000 for failing to provide information by the specified deadlines

- Increase by up to €20.000 if the administrative fee is not paid and the violation continues by the intermediary or the relevant taxpayer.

How we can help:

We are pleased to inform you that our Company operating on multiple DAC 6 platforms can now offer customised DAC 6 services according to your organisation’s needs.

We will be happy to undertake an impact assessment exercise to identify and assess the impact of DAC 6 on your activities, service lines and offerings, determine the policy to be followed and any operational changes needed to meet the DAC 6 challenges.

Following the impact analysis, we can assist in identifying, documenting and submitting any reportable arrangements undertaken by your organisation for the period from 25 June 2018. Also, we can perform a monthly assessment of all arrangements for which you are acting as an intermediary.

Please consider the above information internally and we are always at your disposal for a short introductory meeting where we will have the opportunity to present Cyprus DAC 6 and its implications in more detail and discuss together its potential impact on your organisation and its activities.

We remain at your disposal for any further information or clarifications you may require.